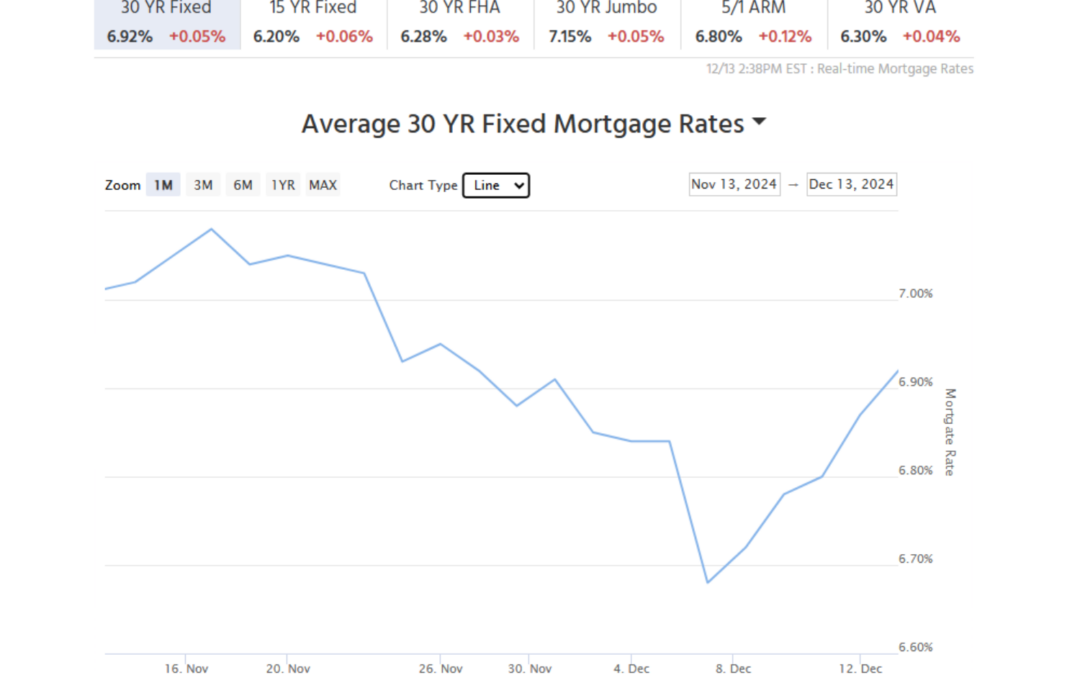

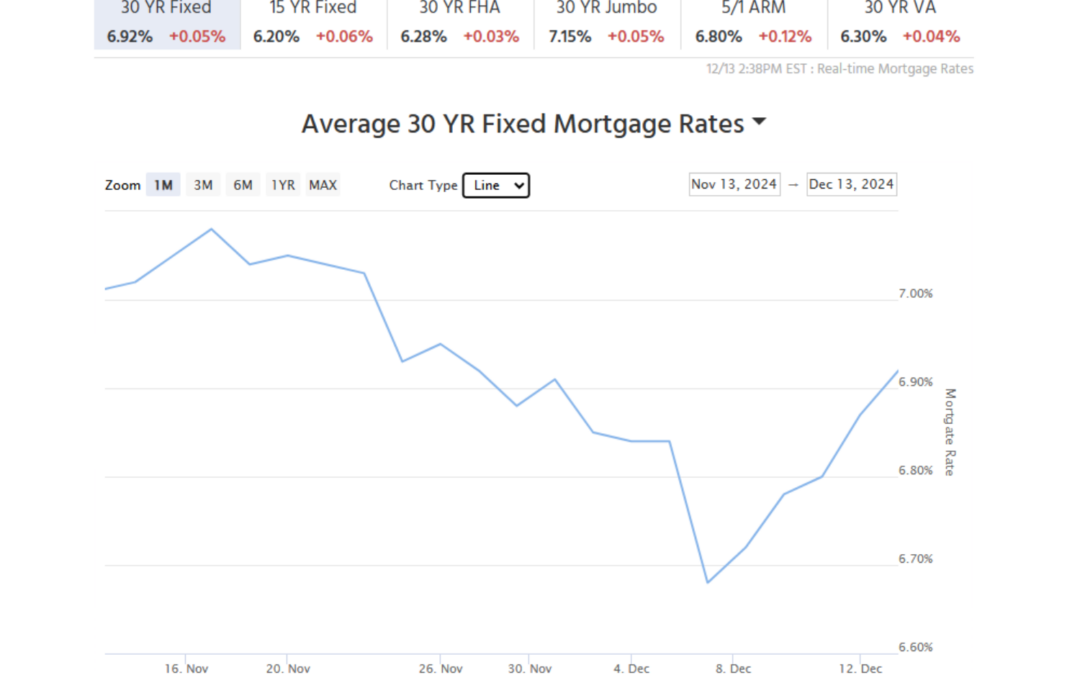

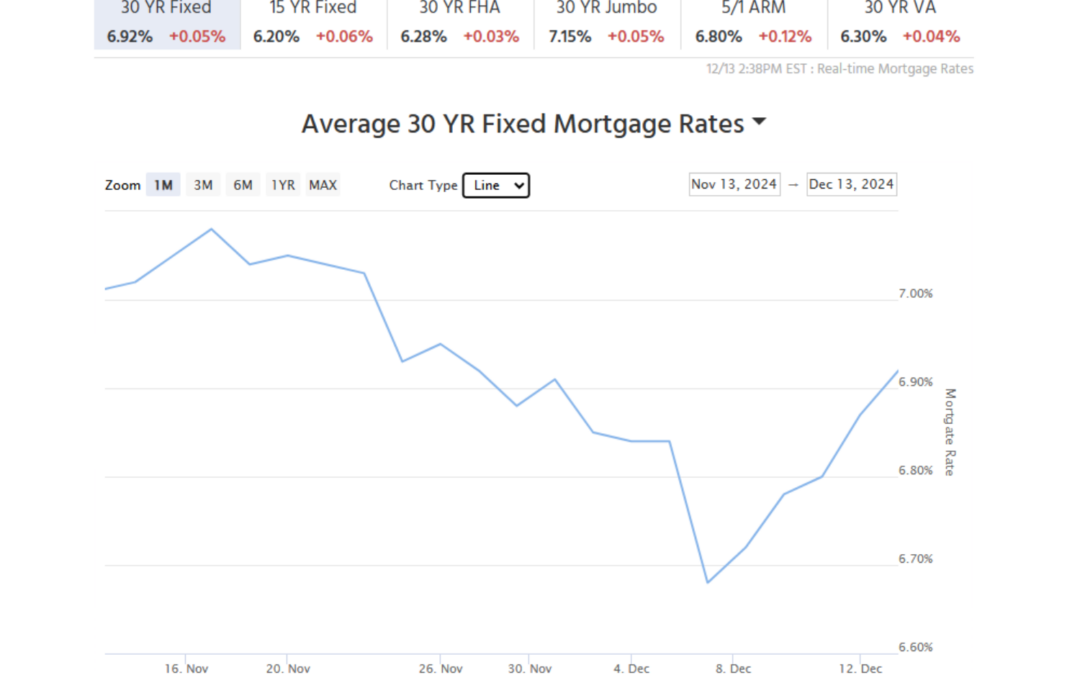

by Chris Kobz, SVP & Director of California Employee Loan Program | Dec 13, 2024 | Market Update, Mortgage Rates

Looking at this month’s trends, it’s clear this past week has been challenging for mortgage rates, which have ticked up slightly each day. As you can see from the graph, rates had improved over the last 30 days, and the news cycle has been buzzing with optimism about...

by Chris Kobz, SVP & Director of California Employee Loan Program | Nov 13, 2024 | Home Buying, Home Refinance, Market Update, Mortgage Rates

With all the news about the Federal Reserve lowering rates, you’d think mortgage rates would be plummeting. Unfortunately, it hasn’t quite played out that way—mortgage rates have actually been inching up! So, what gives? Fed Cuts vs. Mortgage Rates: A Misunderstood...

by Chris Kobz, SVP & Director of California Employee Loan Program | Nov 5, 2024 | First Time Home Buyers, Home Buying, Home Prices, Market Update, Mortgage Rates

With the presidential election around the corner, mortgage rates might be feeling the effects, depending on who wins. Here’s a quick look at what could happen: Rates Are Rising Mortgage rates have increased in recent weeks, influenced by market expectations...

by Chris Kobz, SVP & Director of California Employee Loan Program | Oct 8, 2024 | First Time Home Buyers, Home Buying, Market Update, Mortgage Rates

Timing is everything, maybe. The recent jobs report was a reminder to homebuyers and homeowners looking to refinance that trying to time mortgage rates is tricky and can be risky. Many people expecting lower rates were surprised when they went up instead. Last week,...

by Chris Kobz, SVP & Director of California Employee Loan Program | Sep 10, 2024 | Market Update, Mortgage Rates, Real Estate

Did you hear? Mortgage rates are at a 15-month low right now, and with the Fed cutting rates, they might drop even more. If you’ve been thinking about refinancing your mortgage, this could be a great time to do it and save some money. But before jumping in, let’s...