by Chris Kobz, SVP & Director of California Employee Loan Program | Jun 5, 2025 | Home Refinance, Market Update, Mortgage Rates

If you’ve been keeping an eye on mortgage rates, now is the time to lean in. They’re at a level that could mean serious savings—we’re talking hundreds of dollars a month. If refinancing has been sitting on your to-do list, this could be the window you’ve been...

by Chris Kobz, SVP & Director of California Employee Loan Program | Apr 1, 2025 | Home Buying, Housing Inventory, Market Update, Real Estate

The real estate market is always shifting, and right now, it’s tilting in favor of buyers. If you’ve been thinking about purchasing a home, this could be your golden opportunity. However, waiting too long could mean missing out on key advantages that won’t last...

by Chris Kobz, SVP & Director of California Employee Loan Program | Mar 4, 2025 | Home Refinance, Market Update, Mortgage Rates

With interest rates continuing to drop and exclusive discounts for California’s city, county, and state employees, there has never been a better time to evaluate your financial situation and see how a Cash-Out Refinance can help you consolidate debt, lower your...

by Chris Kobz, SVP & Director of California Employee Loan Program | Jan 14, 2025 | Home Buying, Market Update, Mortgage Rates, Real Estate

As we step into 2025, the housing market remains a hot topic. While last year brought some major challenges, many of those trends are expected to carry over into the new year. Here’s a simple breakdown of Fannie Mae’s key predictions for the housing market in 2025—and...

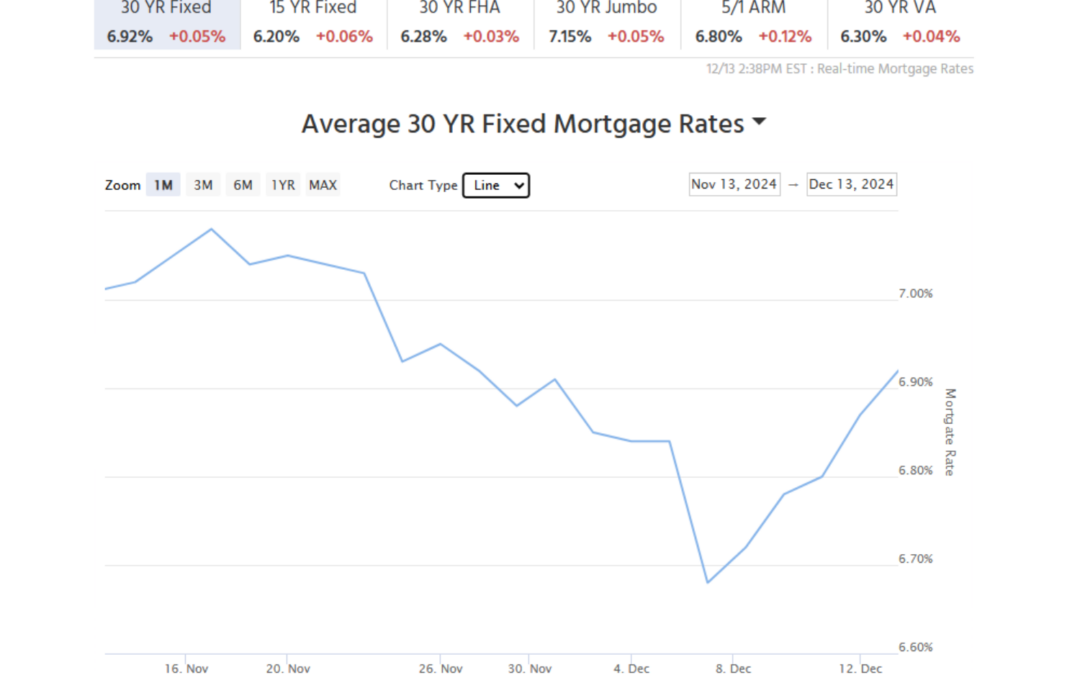

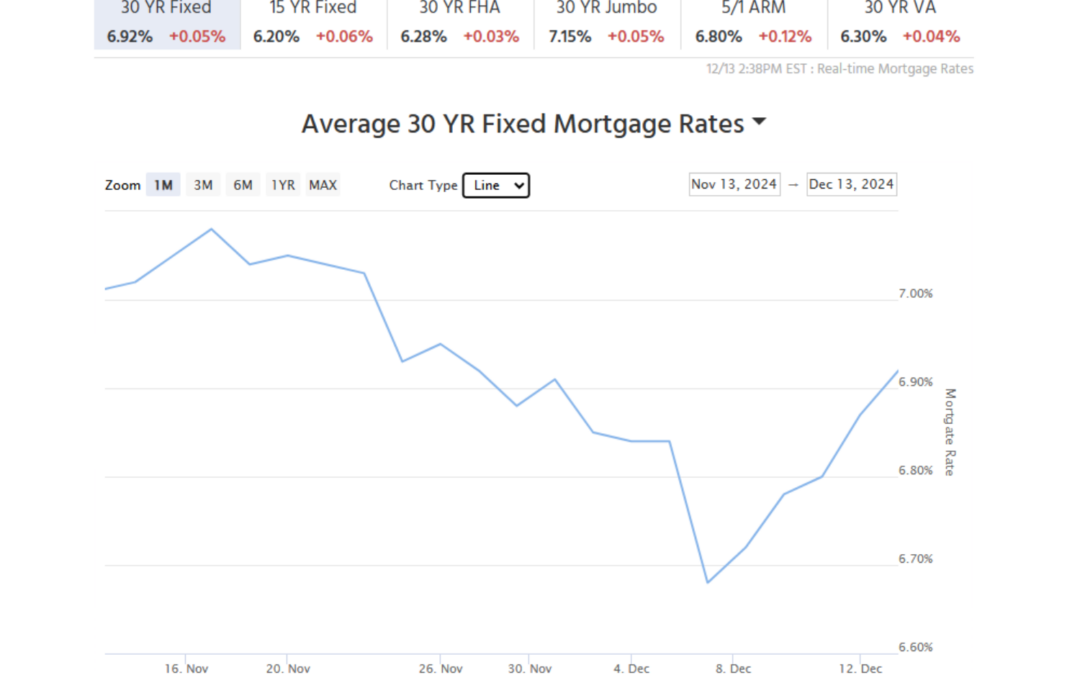

by Chris Kobz, SVP & Director of California Employee Loan Program | Dec 13, 2024 | Market Update, Mortgage Rates

Looking at this month’s trends, it’s clear this past week has been challenging for mortgage rates, which have ticked up slightly each day. As you can see from the graph, rates had improved over the last 30 days, and the news cycle has been buzzing with optimism about...

by Chris Kobz, SVP & Director of California Employee Loan Program | Dec 3, 2024 | First Time Home Buyers, Home Buying, Market Update, Real Estate

More Buying Power for Homebuyers in 2025: Conforming Loan Limits Raised to $806,500! Big news for homebuyers—your purchasing power just got a boost! The Federal Housing Finance Agency (FHFA) has announced an increase in the conforming loan limit for...