Okay. We’re about to get a tad technical here… but I promise it’s good news! Have you ever heard of an LLPA? LLPA’s (Loan-Level Price Adjustments) can be described as the following:

A loan-level pricing adjustment (LLPA) is a risk-based fee assessed to mortgage borrowers using a conventional mortgage. Loan-level pricing adjustments vary by the borrower, based on loan traits such as loan-to-value (LTV), credit score, occupancy type, and number of units in a home. Borrowers often pay LLPAs in the form of higher mortgage rates. LLPA’s aren’t new, in fact, they have been around since 2008 and it’s a way for Fannie/Freddie to adjust the price of a loan for riskier loans and borrowers (higher LTV, lower credit, investment property), without penalizing safer loans and borrowers (lower LTV, better credit, primary home).

Here is an example, you might have a borrower with a 620 credit score and the LLPA’s could be over 3.000%. If the loan is $300,000, that is $9000 dollars the borrower would need to pay. Of course, then can always be offset, but it would come in the form of a higher rate for the borrower.

Here is the good news! Fannie just recently waived all LLPA’s for First Time Home Buyers (FTHB) that are under 100% AMI (Area Median Income) and under 120% AMI in High Balance Counties. This is great news and a huge benefit for FTHB that are under the 100% AMI.

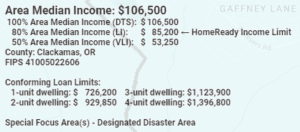

How do you calculate AMI for an FTHB? Fannie has made this easy with their Area Median Income Lookup Tool – https://ami-lookup-tool.fanniemae.com/amilookuptool/ Simply enter the address of the property and it will let you know the 100% AMI for the area (example below). This total does not reflect household income, just the income on the 1003 that was used to qualify for the loan. From the screenshot below, the qualifying income can’t be more than $106,500.

I hope this is helpful and please let us know if you have any questions!